Korean Kiosk Survival Guide: What to Do When Your Foreign Card Fails

Don't let a rejected foreign credit card ruin your Korean adventure.

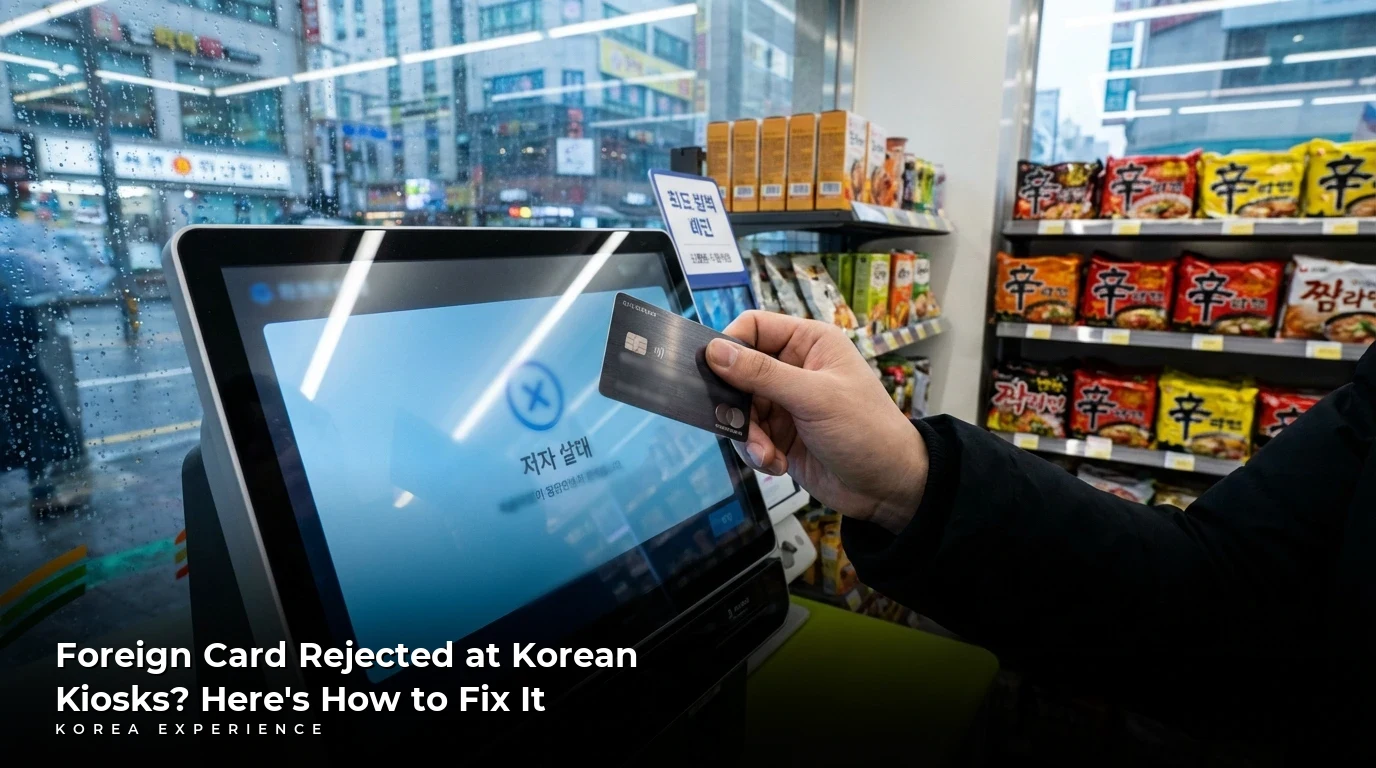

Welcome to Korea, a nation where innovation and efficiency seamlessly blend with a rich cultural tapestry. From bustling Seoul to the serene temples of Gyeongju, your journey promises unforgettable experiences. However, one modern convenience, the self-service kiosk, can sometimes become an unexpected hurdle for international visitors, especially when your overseas credit card is rejected. This comprehensive guide is designed to transform that potential frustration into a minor inconvenience, equipping you with the knowledge, strategies, and essential tips to master kiosk payments and confidently navigate Korea's cashless landscape. We'll delve into common card rejection reasons, immediate on-the-spot solutions, vital alternative payment methods, and crucial proactive preparation steps to ensure your Korean adventure remains smooth and stress-free.

Key Takeaways

- 1Always carry some Korean Won cash (₩50,000-₩100,000) as a backup for unexpected card rejections at kiosks.

- 2Familiarize yourself with foreign-friendly ATMs, typically found at major banks like Woori, KB Kookmin, and Shinhan, offering withdrawals up to ₩1,000,000.

- 3Prepare multiple international credit/debit cards from different networks (Visa, Mastercard) and notify your bank about your travel plans.

Understanding Korea's Kiosk Culture: The Rise of Self-Service

Korea is at the forefront of technological integration, and self-service kiosks are a prime example. You'll encounter them virtually everywhere: fast-food restaurants, cafes, movie theaters, train stations, and even some smaller eateries. This widespread adoption is driven by a quest for efficiency, reduced labor costs, and a preference for quick, streamlined transactions. For many Koreans, ordering and paying via a kiosk is second nature, often taking less than 30 seconds for a typical transaction. However, for international visitors, this can sometimes present a challenge.

Why Kiosks Are King in Korea

The proliferation of kiosks isn't just a trend; it's a fundamental shift in the service industry. For businesses, they offer significant advantages, including reducing staffing needs, minimizing order errors, and processing transactions much faster. For customers, they provide convenience, privacy, and often, multi-language support. A survey in 2024 indicated that over 80% of major fast-food chains in Korea now primarily use kiosks for ordering, a significant jump from 60% just three years prior. This digital transformation is likely to continue, making a solid understanding of kiosk usage essential for any traveler.

Kiosk Etiquette in Korea

Even if you're struggling, try to complete the transaction yourself before asking for help. Koreans appreciate self-sufficiency. If assistance is needed, wait for a natural break in service or politely signal a staff member. A simple "Jeogiyo" (Excuse me) can get their attention.

Decoding Your Card Rejection: Common Culprits and Solutions

The moment your overseas credit card is rejected at a kiosk can feel bewildering. Often, the reasons are not immediately clear, and the kiosk may only display a generic error message. Understanding the most common causes can help you troubleshoot on the spot.

1. International Card Compatibility Issues

Many Korean kiosks are primarily designed and optimized for domestic Korean credit and debit cards. While major international networks like Visa and Mastercard are widely accepted, the underlying payment gateway or software on some older or smaller kiosks might not fully support all foreign card types or specific bank issuers. This is especially true for lesser-known international card brands.

"I've seen many tourists struggle with older kiosks, particularly in traditional markets or smaller, independent cafes. Sometimes, it's not the card itself, but the terminal's software that's the issue. Always try a different card if you have one, or look for a nearby convenience store with a newer terminal."

2. The Silent Killer: 3D Secure Verification

One of the most frequent yet invisible reasons for foreign card rejection is the 3D Secure verification protocol (Verified by Visa, Mastercard SecureCode). Many online and some physical card terminals in Korea are configured to require this extra layer of security. If your overseas card is prompted for 3D Secure but your bank doesn't support it for that specific type of transaction or if the kiosk's system can't process the verification pop-up, the transaction will fail silently. Approximately 70% of Korean online retailers use 3D Secure, and an increasing number of physical terminals are implementing similar checks.

3. Card Network Limitations

While Visa and Mastercard boast extensive global acceptance, some smaller kiosks or specific merchants might have limited network agreements. American Express, Discover, and JCB cards, for instance, have significantly lower acceptance rates in Korea compared to Visa and Mastercard. A 2023 financial report indicated that Visa and Mastercard are accepted at over 90% of card terminals nationwide, while American Express acceptance drops to around 60%, and Discover/JCB even lower.

4. Merchant-Specific Policies or Terminal Configurations

Some smaller businesses might opt out of accepting foreign cards due to higher transaction fees charged by international payment processors. Other times, their card reader might be a basic model that doesn't effectively communicate with diverse international banking systems. This is more common in independent shops or smaller eateries rather than large chains.

📋 Card Acceptance Rates in Korea

5. Insufficient Funds or Daily/Transaction Limits

This is a more straightforward reason but often overlooked in the moment of panic. Ensure you have sufficient funds in your account. Also, check with your bank about any daily spending limits or single transaction limits they might impose, especially for international purchases. Some banks automatically flag transactions over a certain amount (e.g., $500 USD) if they haven't been notified of your travel.

6. Magnetic Strip vs. Chip Problems

While chip-and-PIN (EMV) is standard, some older kiosks might still rely on magnetic strip readers, or conversely, might struggle with a chip that isn't read perfectly on the first try. Always try inserting the chip first, then if that fails, look for a swipe option, though it's less common now.

Always Notify Your Bank

Before traveling, call your bank and credit card companies to inform them of your travel dates and destinations. This significantly reduces the chance of your card being flagged for suspicious activity and subsequently rejected. Failing to do so can lead to an immediate block on your card.

On-the-Spot Solutions When Your Card Fails

Panic is natural, but having a plan of action can quickly resolve most kiosk payment issues.

1. The "Try Again" Method

Sometimes, a momentary glitch in the network or the kiosk's system can cause a rejection. Simply trying to re-insert your card or re-enter your PIN after a few seconds can surprisingly resolve the issue. Reports suggest that as many as 1 in 5 initial rejections might clear upon a second attempt. Don't be shy about trying it 2-3 times.

2. Switch to a Different Card

This is why carrying multiple cards is paramount. If your Visa card fails, try your Mastercard. If both fail, and you have an American Express or Discover, give it a shot, but manage your expectations given their lower acceptance. Having a debit card from a different bank can also be a lifesaver. Ensure these cards are from different banking institutions if possible, as it diversifies your payment options.

3. Change the Kiosk Language to English (or your preferred language)

Most modern kiosks offer multiple language options, typically including English. Sometimes, navigating in a language you don't understand can lead to missed prompts or incorrect selections. Look for a flag icon or a "Language" button on the screen, usually in the top corner.

📖 How to Change Kiosk Language

Step 1: Locate Language Option

On the kiosk's main screen, look for a small flag icon (e.g., British or American flag) or a button labeled 'Language' or '언어'. It's often in the top right or bottom left corner.

Step 2: Select Your Language

Tap the language icon/button and choose 'English' from the displayed list. The screen should immediately refresh to your chosen language.

Step 3: Restart Your Order (if necessary)

If you were mid-order, you might need to go back to the beginning to ensure all prompts are in English. Proceed with your purchase from the start.

4. Seek Human Assistance

If all else fails, don't hesitate to ask a staff member for help. Many Koreans, especially those in service industries, have basic English proficiency, or at least enough to understand your predicament.

Essential Korean Phrases for Help

- "Jeogiyo" (저기요): Excuse me (to get attention)

- "Doo-wa joo-se-yo" (도와주세요): Please help me

- "Ka-deu ga an-dwae-yo" (카드가 안돼요): My card is not working

- "Hyun-geum-euro joo-moon ha-go ship-eo-yo" (현금으로 주문하고 싶어요): I want to order with cash

- "Yeong-su-jeung joo-se-yo" (영수증 주세요): Please give me a receipt For many situations, simply holding up your card and shaking your head with a questioning look can convey your problem effectively.

The Korean Cash Lifeline: ATMs and Currency Exchange

While Korea is rapidly moving towards a cashless society, cash (Korean Won, ₩) remains an essential backup. Many smaller shops, street food vendors, or even some specific kiosks might still prefer or only accept cash.

1. The Importance of Carrying Korean Won

Having a modest amount of cash, perhaps ₩50,000 to ₩100,000, can save you from many sticky situations. It's especially useful for emergency taxi rides, small purchases in traditional markets, or street food stalls where card readers are rare. The average street food item typically costs between ₩3,000 and ₩7,000.

2. Finding Foreign-Friendly ATMs (Global ATMs)

Not all ATMs in Korea accept foreign cards. You need to look for "Global ATMs." These are predominantly found at major Korean banks like Woori Bank (우리은행), KB Kookmin Bank (KB국민은행), Shinhan Bank (신한은행), Hana Bank (하나은행), and Nonghyup (농협), as well as dedicated Global ATM machines often located in subway stations, convenience stores (e.g., 7-Eleven, GS25, CU), and major tourist areas. Citi Bank also has a presence and their ATMs are reliably foreign-friendly.

Look for logos of your card network (Visa, Mastercard, Plus, Cirrus) on the ATM itself. Most global ATMs offer English language options from the start screen.

Woori Bank Global ATM(우리은행 글로벌 ATM)

3. ATM Withdrawal Process, Fees, and Limits

Using a Global ATM is similar to using one at home.

- Insert your card.

- Select "English."

- Choose "Withdrawal" (인출).

- Select "Checking" or "Savings" (예금/저축) if prompted (usually just "Checking").

- Enter the amount.

- Enter your 4-digit PIN.

- Confirm the transaction.

📖 Using a Foreign-Friendly ATM in Korea

Step 1: Locate a Global ATM

Find an ATM with 'Global ATM' branding or logos like Visa, Mastercard, Plus, Cirrus. Major banks (Woori, Shinhan, Kookmin) are your safest bet.

Step 2: Insert Card and Select Language

Insert your debit or credit card. The ATM will usually automatically prompt you to select a language; choose 'English'.

Step 3: Choose Transaction Type

Select 'Withdrawal' (인출). You may be asked to choose 'Checking' or 'Savings' – select 'Checking' for most debit cards.

Step 4: Enter Amount and PIN

Input the desired amount of Korean Won. Be mindful of limits. Then, enter your 4-digit PIN (Personal Identification Number).

Step 5: Confirm and Collect

Review the transaction details on the screen, including any fees, and confirm. Collect your cash, card, and receipt.

Fees: You'll typically incur two types of fees:

- Local ATM Fee: Korean banks usually charge a flat fee per transaction, often around ₩3,600 (approximately $2.70 USD, depending on exchange rates).

- Your Bank's International Transaction Fee: Your home bank might charge a foreign transaction fee (often 1-3% of the amount) and/or a flat international ATM withdrawal fee (e.g., $5).

Limits: Most Global ATMs allow a maximum withdrawal of ₩500,000 to ₩1,000,000 per transaction. Your home bank will also have its own daily withdrawal limits, which may be lower. Always aim to withdraw larger amounts less frequently to minimize flat fees.

📋 ATM Withdrawal Details

4. Currency Exchange Services

For larger amounts of cash, currency exchange booths or bank branches offer better rates than airport exchangers. Look for official "Money Exchange" signs. Banks generally offer competitive rates, though they might have longer waiting times. Private exchange services, especially in areas like Myeongdong, can sometimes offer slightly better rates but confirm the official rate board. On average, city currency exchange rates can be 5-10% more favorable than those at Incheon International Airport.

💵 Cost Comparison: Getting Cash

Convenient but adds up with multiple small withdrawals.

Best rates for larger sums, but requires finding an exchange office during business hours.

Embracing Mobile Payments: Korea's Digital Edge

Korea is a global leader in mobile payment adoption. While setting up local apps like Kakao Pay or Naver Pay can be challenging for tourists without a Korean phone number or bank account, some international options are gaining traction.

1. Kakao Pay & Naver Pay: The Dominant Duo

These are the most ubiquitous mobile payment systems in Korea. Kakao Pay, integrated with the popular KakaoTalk messaging app (used by over 40 million Koreans), and Naver Pay, tied to the Naver search engine (used by over 30 million), are accepted at millions of merchants. However, for international travelers, full registration typically requires a Korean resident registration number and a local bank account, making them largely inaccessible for short-term visitors. There are occasional limited options for linking international cards, but they are not universally reliable or widely supported.

2. Zero Pay

Zero Pay is a government-backed QR code payment system designed to reduce merchant fees. While it's gaining traction, it also generally requires a Korean bank account for use, meaning it's not a viable option for most tourists.

3. Apple Pay & Google Pay

Apple Pay officially launched in Korea in 2023, and Google Pay has been present for longer. Their acceptance is growing, but it's not yet universal, especially compared to their prevalence in Western countries. You'll find Apple Pay accepted at major department stores, some large chain cafes, and an increasing number of retailers with compatible NFC terminals. An estimated 20% of retail points of sale now accept Apple Pay, and this number is steadily climbing. It's always worth checking for the Apple Pay or Google Pay logo at the checkout.

Mobile Payment Options for Tourists

| Feature | Kakao Pay | Naver Pay | Apple Pay | Google Pay |

|---|---|---|---|---|

| Primary User Base | Korean Locals | Korean Locals | Global (Growing in KR) | Global (Growing in KR) |

| Foreign Card Linking | Limited/Complex | Limited/Complex | Yes (where accepted) | Yes (where accepted) |

| Required for Setup | KR Phone/Bank | KR Phone/Bank | Compatible iPhone/Watch | Compatible Android |

| Acceptance Rate (KR) | Very High (KR users) | Very High (KR users) | Moderate & Growing | Moderate & Growing |

4. Prepaid & Debit Cards for Travelers

For digital payments without the need for a Korean bank account, dedicated traveler debit cards like Wise (formerly TransferWise) or Revolut can be excellent alternatives. These cards often offer:

- Better Exchange Rates: They typically use the mid-market exchange rate, saving you 2-4% compared to traditional bank cards.

- Lower Fees: Reduced or no foreign transaction fees.

- Easy Top-up: Load money from your home bank account in your local currency.

- Card Functionality: They operate as regular Visa or Mastercard debit cards, accepted at any terminal that supports those networks.

"I highly recommend getting a Wise or Revolut card before your trip. I've personally saved hundreds of dollars on exchange rates and ATM fees over the years. Plus, having a second physical card that's separate from your main bank account adds an extra layer of security. I usually keep about ₩200,000 loaded on my Wise card for emergencies."

5. T-Money Card with Payment Functionality

While primarily known as a transit card, a T-Money card (or similar cashbee card) can also be used for small purchases at convenience stores (GS25, CU, 7-Eleven, E-Mart24), some vending machines, and even some cafes. You load it with cash at subway stations or convenience stores. It's not a credit card replacement, but it's a handy way to pay for low-value items without dealing with a bank card. Maximum load amount for a T-Money card is typically ₩500,000.

Traveler Debit Cards vs. Traditional Credit Cards

- ✓Better exchange rates (mid-market rates)

- ✓Lower or no foreign transaction fees

- ✓Easy to manage budget and top-up

- ✓Separates travel funds from main bank account for security

- ✓Works as a standard Visa/Mastercard debit card

- ✗Requires pre-loading funds

- ✗May have daily withdrawal limits (though often higher than standard bank cards)

- ✗Some ATMs might still charge a local fee

- ✗Requires activation and setup before travel

Proactive Preparation: Before You Go

The best way to survive kiosk payment rejections is to prevent them entirely or have robust backup plans. A little preparation goes a long way.

1. Notify Your Bank(s) of Your Travel Plans

As mentioned earlier, this is crucial. Contact your credit and debit card issuers and inform them of your travel dates and destination (Korea). This prevents them from flagging your transactions as fraudulent and freezing your card. Many banks now allow you to do this via their mobile app or online banking portal in just a few clicks.

2. Carry Multiple Payment Methods

Always pack at least two different international credit/debit cards, ideally from different banks and different networks (e.g., one Visa, one Mastercard). This greatly increases your chances of success if one card or network faces compatibility issues. Consider a dedicated traveler's debit card like Wise or Revolut as an excellent third option.

📊 Impact of Pre-Travel Notification

3. Download Essential Apps and Set Up VPN

While not directly payment-related, having essential apps can help you navigate situations where you need to find an ATM or communicate.

- Naver Map / KakaoMap: Essential for navigation, locating banks and ATMs. Google Maps is less effective in Korea.

- Papago / Google Translate: For quick translations when asking for help.

- Your Bank's Mobile App: To monitor transactions and manage card settings (e.g., temporarily unblock a card).

- VPN: A reliable VPN service might be necessary for accessing some home country banking apps that have geo-restrictions. Many public Wi-Fi networks in Korea are fast, but a VPN offers security. A good VPN service costs around $5-10 USD per month.

4. Always Carry Emergency Cash

Even in this digital age, cash is king for emergencies. Keep at least ₩50,000 to ₩100,000 in your wallet for small purchases, unexpected situations, or when all digital payments fail. This small amount can cover a meal (₩10,000-₩15,000), a coffee (₩5,000-₩7,000), or a short taxi ride (initial fare ~₩4,800).

Pre-Departure Checklist for Payments

- Notify all your banks and credit card companies of your travel plans.

- Pack at least two international credit cards (Visa & Mastercard recommended).

- Consider a traveler's debit card (Wise/Revolut) with pre-loaded funds.

- Download Naver Map/KakaoMap and a translation app (Papago).

- Familiarize yourself with Global ATM locations near your accommodation.

- Ensure your phone is unlocked and consider an eSIM for local data (around ₩20,000-₩30,000 for 5GB data for 15 days).

- Have at least ₩50,000 in Korean Won for immediate needs.

Conclusion: Mastering Payments in the Land of Morning Calm

Navigating payment systems in a foreign country can be daunting, and Korea's advanced kiosk culture presents its unique challenges. However, with the right knowledge and preparation, a rejected overseas credit card doesn't have to derail your plans. By understanding why cards are rejected, knowing your immediate backup options, embracing both cash and modern mobile solutions, and taking proactive steps before you even land, you can confidently engage with Korea's payment landscape. From enjoying a quick coffee to grabbing a delicious street food snack, you'll be well-equipped to handle any transaction with ease, allowing you to focus on creating unforgettable "KoreaExperience" memories.

❓ Frequently Asked Questions

Have more questions?Contact us →

About the Author

Korea Experience Team

Written by the Korea Experience editorial team - experts in Korean medical tourism, travel, and culture with years of research and firsthand experience.

Explore more in Living in Korea

Everything expats and long-term visitors need to know — from visa requirements and housing to banking, healthcare, and daily life tips.

Browse All Living in Korea ArticlesContinue Reading

Explore more articles you might find interesting

Navigating Baemin without an ARC in 2026 is simpler than you think. Discover reliable pay-at-door methods and effective alternatives for food delivery in Korea.

Discover the best Korea SIM cards for long-term stays. Compare MVNOs, postpaid plans, and verification steps to save money and stay connected.

The short answer? Korean kiosks reject foreign cards because of 3D Secure authentication failures, IC chip mismatches, and midnight maintenance windows.

The ultimate guide to finding meaningful volunteer work in Seoul for 2026. Discover animal shelters, soup kitchens, and language exchange programs.

The short answer? Korea's recycling system is incredibly strict—you need to separate everything from food waste to clear PET bottles, and if you mess it up.

Master the art of the Korean visa run in 2026. Comprehensive guide on routes, costs, immigration risks, and re-entry tips for long-term travelers.